Tax Tips for Property Investors: Deductions

Owning an investment property can have many benefits – and as a property owner, you need to know your rights and obligations. Tax time can be stressful for many, but for property investment owners it’s easy to make mistakes when it comes to claiming tax deductions. If you’re unsure of how to proceed with your […]

Tax Tips for Property Investors: Deductions for Vacant Land

In July 2019, there were changes made to the legislation to limit deductions that can be claimed for holding vacant land. These changes have confused many investors, and while many deductions are no longer available – many still are. To find out more about this limit, contact us here. To summarise: deductions for vacant land […]

Tax Tips for Property Investors: Selling Your Rental Property

Whether you’ve decided to move on from a rental property or your current one isn’t providing enough income – there are a few things to consider before selling. When you sell a rental property, you either gain or lose capital (refer to our ‘Tax Tips for Property Investors: What is Capital Gains Tax (CGT)?’ for […]

Tax Tips for Property Investors: Negative Gearing

If you’re looking to invest in property, it’s important to understand what negative gearing is and all of the benefits, risks and tax considerations that come with it. Negative gearing isn’t a phrase you’d find within tax legislation, but gearing is an important aspect of any investment. What is gearing? When you borrow money to […]

Tax Tips for Property Investors: Granny Flats and CGT

A granny flat is typically a second dwelling separate from the main house on your property. As a popular form of housing for people of all ages across Australia, it’s important to consider the tax benefits and implications when considering renting out. A granny flat arrangement is a written agreement that gives an eligible person […]

Tax Tips for Property Investors: Rental Income Explained

Anyone who owns an investment property knows that the main source of income comes down to one thing: rent. Your rental and other rental-related income is the full amount of rent and associated payments that you receive (or become entitled to) when you rent out your property. The rental income also includes rent or associated […]

Tax Tips for Property Investors: What is Capital Gains Tax (CGT)?

You’ve secured an investment property, or maybe you’ve got a couple under your belt – great! What’s next? It’s time to brush up on your tax knowledge; specifically, captain gains tax. Capital gains tax (CGT) – what is it? If you acquired a rental property after 19 September 1985 (or have made certain capital improvements […]

Purpose of a budget calculator?

Budget Calculator A budget calculator is a tool that helps individuals and businesses plan and manage their finances by creating a budget and tracking expenses. This tool allows users to input their income and expenses, and then calculates the difference between the two to determine if they are living within their means or if they […]

Should You buy Or rent ?

Buy v/s Rent Renting versus buying a home is a decision that depends on various factors such as your financial situation, lifestyle preferences, and future plans. Renting can be a good option for people who are not ready to commit to a long-term residence, plan to move frequently, or have a limited budget. Renting requires […]

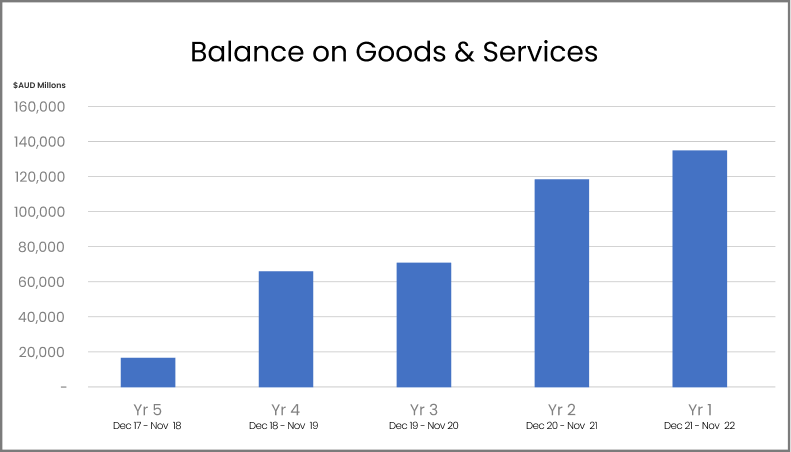

Significant Positive Balance of Trade

Significant Positive Balance of Trade: A Beacon of hope Amidst Economic Turmoil for Australia As many economies, including Australia, are facing the possibility of recession, it’s important to note that there may be a silver lining. Australia’s balance of trade, or the difference between the value of our exported goods and services and imported goods and services, […]