A good depreciation schedule would allow you to foresee how depreciation impacts your tax position. Fundamentally depreciation assumes effective life of an asset.

Effective life is number of years an asset is expected to last. E.g. a car typically has effective life of 8 years.

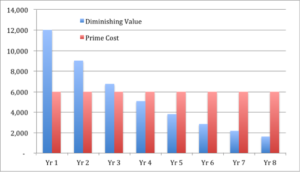

There are two methods available for depreciation:

Diminishing Value: Allows you to claim higher amount of deductions in initial years

Prime Cost: Allows fixed amount to be claimed over the life of asset.

We take in to account not only your current situation but also your future revenue likelihood before deciding appropriate method of depreciation to be used. For example, if it is more likely your future year’s income will be higher than current year; prime cost method might suit you better.

A good depreciation schedule would list every single asset in your investment property and workout yearly figure for your account to use.

In order to get an estimate of what you might be able to claim in depreciation, check on https://www.bmtqs.com.au/tax-depreciation-calculator?company=sapta