Tax Tips for Property Investors: Granny Flats and CGT

A granny flat is typically a second dwelling separate from the main house on your property. As a popular form of housing for people of

Strategic planning is equally important for individuals and businesses as it plays critical role for asset protection, managing cash flow and minimising tax. Lodging a tax return should be part of your greater strategy and not the strategy.

Amit Aggarwal is a specialist property and business tax accountant,. He assists people with:

When working with you on your wealth creation strategy Amit aims to have the essentials sorted so you and your family can live a life beyond numbers without worry.

Amit has in-depth knowledge of property transactions. These include GST and Capital Gains Tax. This knowledge is critical when implementing an effective strategy. Amit assists with:

Property transactions can take years to execute. and you need a trusted advisor to help you see through end effect. Hence put measures in place today so you can live a life beyond numbers.

Business environments has are dynamic, stay ahead with regular reviews and plans.

Prepare and lodge tax returns for you as an, individual, business or trust fund.

Feasibilities, JVs, depreciation, GST assessments and tax -we have you covered.

We offer a full range of bookkeeping services tailored to suit your business needs.

Corporate secretarial requirements and annual company review is sorted.

Combine your accounting, tax, compliance, advice and support into a monthly fee.

We understand complex SMSF compliance including new legislative changes.

Legal and accounting advice to protect your property and business ventures.

A granny flat is typically a second dwelling separate from the main house on your property. As a popular form of housing for people of

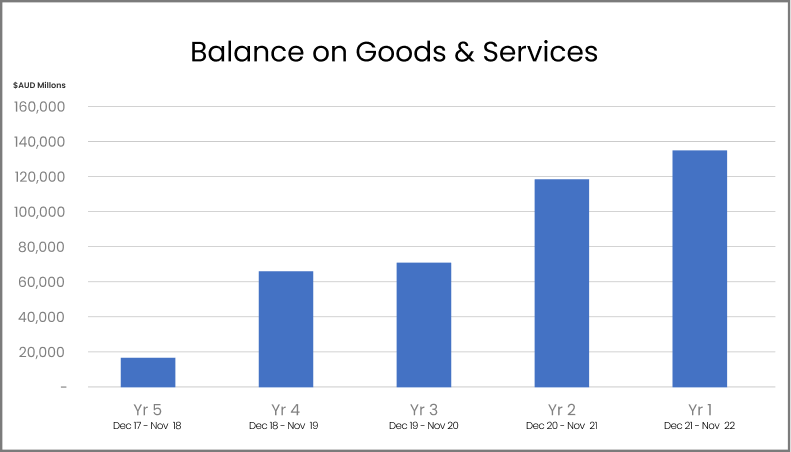

Significant Positive Balance of Trade: A Beacon of hope Amidst Economic Turmoil for Australia As many economies, including Australia, are facing the possibility of recession, it’s important

Self employed client buy following property in SMSF We supported the client’s purchasing investment property in SMSF in a challenging situation. Client bought this in a

Typically, home loan repayment will have principal and interest components. Thus, reducing your home loan gradually. However, with interest only loans, only interest is paid

When we look at our personal finances – it seems easy to create healthy habits. Make sure to spend less than you make, invest in

The world we live in is drastically different from five years ago, and it continues to change. After the pandemic’s peak in March of 2020

We are located in the key Victorian hub of SME and startups, in south east Melbourne – City of Monash. This is to ensure we are in the middle of future businesses and individual success.