Should You buy Or rent ?

Buy v/s Rent Renting versus buying a home is a decision that depends on various factors such as your financial situation, lifestyle preferences, and future plans. Renting can be a good option for people who are not ready to commit to a long-term residence, plan to move frequently, or have a limited budget. Renting requires […]

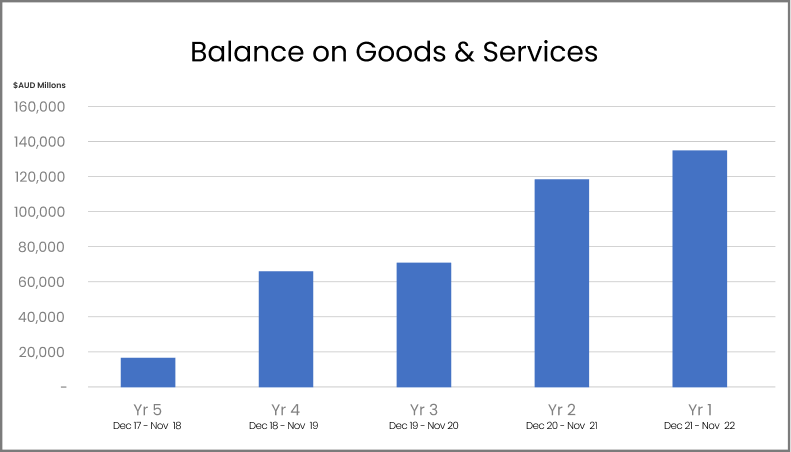

Significant Positive Balance of Trade

Significant Positive Balance of Trade: A Beacon of hope Amidst Economic Turmoil for Australia As many economies, including Australia, are facing the possibility of recession, it’s important to note that there may be a silver lining. Australia’s balance of trade, or the difference between the value of our exported goods and services and imported goods and services, […]

Positive Cashflow Property in SMSF

Bought this strong cash flow positive property in SMSF earlier this year We concluded purchase of this amazing block of 3 units for SMSF clients. 2 couples joined hands to form SMSF to buy this property. It was a combination of self employed and salary & wages employees. Challenges: Being a block of 3 units […]

Strong capital growth Investment Property in SMSF

Self employed client buy following property in SMSF We supported the client’s purchasing investment property in SMSF in a challenging situation. Client bought this in a capital growth area with the aim to grow wealth for retirement. Challenges The client had only 1 yr.’s super contributions which typically is typically a no go zone for self-employed […]

Principal & Interest V Interest Only loans

Typically, home loan repayment will have principal and interest components. Thus, reducing your home loan gradually. However, with interest only loans, only interest is paid each month, leaving original principal amount outstanding at the end of interest only term. This means for example at the end of 2 years interest only term you will still […]

5 ways to shift your money mindset

When we look at our personal finances – it seems easy to create healthy habits. Make sure to spend less than you make, invest in your future and don’t buy things for the sake of buying them. But putting this mindset into practise is much more complex than one would think. Understanding where money struggles […]

A beginners guide to investing

The world we live in is drastically different from five years ago, and it continues to change. After the pandemic’s peak in March of 2020 – there was a spike in young Australians looking to invest their money into stocks. But around 64 per cent of those adults didn’t know how investments worked nor how […]

Top-rated money management apps of 2022

If you’re looking for a way to start taking control of your finances – your phone could have all the answers you need. Budgeting and saving apps have become a staple in most people’s lives thanks to the innovation of saving, tracking and budgeting systems. Saving money and sticking to your budget can be tricky […]

Taking time out – reflection and planning your life

When it comes to money and your plans, it can be hard to balance all your different wants and dreams and prepare for those unexpected events in life. No one cares more about your financial well-being than you do – so you need to take time and reflect on your goals and needs with money. […]

Wealth building: time well spent

Wealth creation – in its simplest form boils down to time management. To create wealth, you have to spend time looking for ways. The desire for individuals to have whatever they want now and pay for it later means they go without the planning process to ensure they have enough wealth for the product. […]